PDF Publication Title:

Text from PDF Page: 004

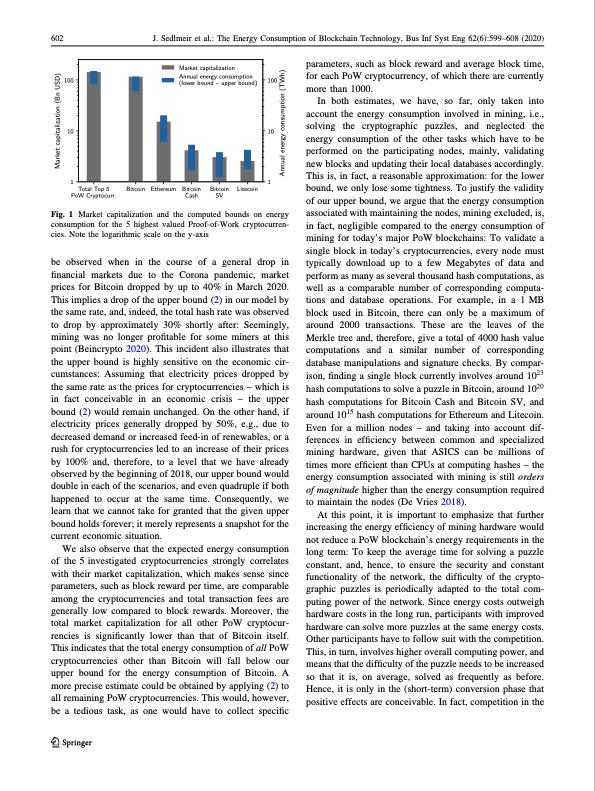

602 J. Sedlmeir et al.: The Energy Consumption of Blockchain Technology, Bus Inf Syst Eng 62(6):599–608 (2020) 100 100 10 10 11 Total Top 5 Bitcoin Ethereum Bitcoin Bitcoin Litecoin PoW Cryptocurr. Cash SV Fig. 1 Market capitalization and the computed bounds on energy consumption for the 5 highest valued Proof-of-Work cryptocurren- cies. Note the logarithmic scale on the y-axis Market capitalization Annual energy consumption (lower bound – upper bound) be observed when in the course of a general drop in financial markets due to the Corona pandemic, market prices for Bitcoin dropped by up to 40% in March 2020. This implies a drop of the upper bound (2) in our model by the same rate, and, indeed, the total hash rate was observed to drop by approximately 30% shortly after: Seemingly, mining was no longer profitable for some miners at this point (Beincrypto 2020). This incident also illustrates that the upper bound is highly sensitive on the economic cir- cumstances: Assuming that electricity prices dropped by the same rate as the prices for cryptocurrencies – which is in fact conceivable in an economic crisis – the upper bound (2) would remain unchanged. On the other hand, if electricity prices generally dropped by 50%, e.g., due to decreased demand or increased feed-in of renewables, or a rush for cryptocurrencies led to an increase of their prices by 100% and, therefore, to a level that we have already observed by the beginning of 2018, our upper bound would double in each of the scenarios, and even quadruple if both happened to occur at the same time. Consequently, we learn that we cannot take for granted that the given upper bound holds forever; it merely represents a snapshot for the current economic situation. We also observe that the expected energy consumption of the 5 investigated cryptocurrencies strongly correlates with their market capitalization, which makes sense since parameters, such as block reward per time, are comparable among the cryptocurrencies and total transaction fees are generally low compared to block rewards. Moreover, the total market capitalization for all other PoW cryptocur- rencies is significantly lower than that of Bitcoin itself. This indicates that the total energy consumption of all PoW cryptocurrencies other than Bitcoin will fall below our upper bound for the energy consumption of Bitcoin. A more precise estimate could be obtained by applying (2) to all remaining PoW cryptocurrencies. This would, however, be a tedious task, as one would have to collect specific parameters, such as block reward and average block time, for each PoW cryptocurrency, of which there are currently more than 1000. In both estimates, we have, so far, only taken into account the energy consumption involved in mining, i.e., solving the cryptographic puzzles, and neglected the energy consumption of the other tasks which have to be performed on the participating nodes, mainly, validating new blocks and updating their local databases accordingly. This is, in fact, a reasonable approximation: for the lower bound, we only lose some tightness. To justify the validity of our upper bound, we argue that the energy consumption associated with maintaining the nodes, mining excluded, is, in fact, negligible compared to the energy consumption of mining for today’s major PoW blockchains: To validate a single block in today’s cryptocurrencies, every node must typically download up to a few Megabytes of data and perform as many as several thousand hash computations, as well as a comparable number of corresponding computa- tions and database operations. For example, in a 1 MB block used in Bitcoin, there can only be a maximum of around 2000 transactions. These are the leaves of the Merkle tree and, therefore, give a total of 4000 hash value computations and a similar number of corresponding database manipulations and signature checks. By compar- ison, finding a single block currently involves around 1023 hash computations to solve a puzzle in Bitcoin, around 1020 hash computations for Bitcoin Cash and Bitcoin SV, and around 1015 hash computations for Ethereum and Litecoin. Even for a million nodes – and taking into account dif- ferences in efficiency between common and specialized mining hardware, given that ASICS can be millions of times more efficient than CPUs at computing hashes – the energy consumption associated with mining is still orders of magnitude higher than the energy consumption required to maintain the nodes (De Vries 2018). At this point, it is important to emphasize that further increasing the energy efficiency of mining hardware would not reduce a PoW blockchain’s energy requirements in the long term: To keep the average time for solving a puzzle constant, and, hence, to ensure the security and constant functionality of the network, the difficulty of the crypto- graphic puzzles is periodically adapted to the total com- puting power of the network. Since energy costs outweigh hardware costs in the long run, participants with improved hardware can solve more puzzles at the same energy costs. Other participants have to follow suit with the competition. This, in turn, involves higher overall computing power, and means that the difficulty of the puzzle needs to be increased so that it is, on average, solved as frequently as before. Hence, it is only in the (short-term) conversion phase that positive effects are conceivable. In fact, competition in the 123 Market capitalization (Bn USD) Annual energy consumption (TWh)PDF Image | The Energy Consumption of Blockchain Technology

PDF Search Title:

The Energy Consumption of Blockchain TechnologyOriginal File Name Searched:

wi-1196.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |