PDF Publication Title:

Text from PDF Page: 009

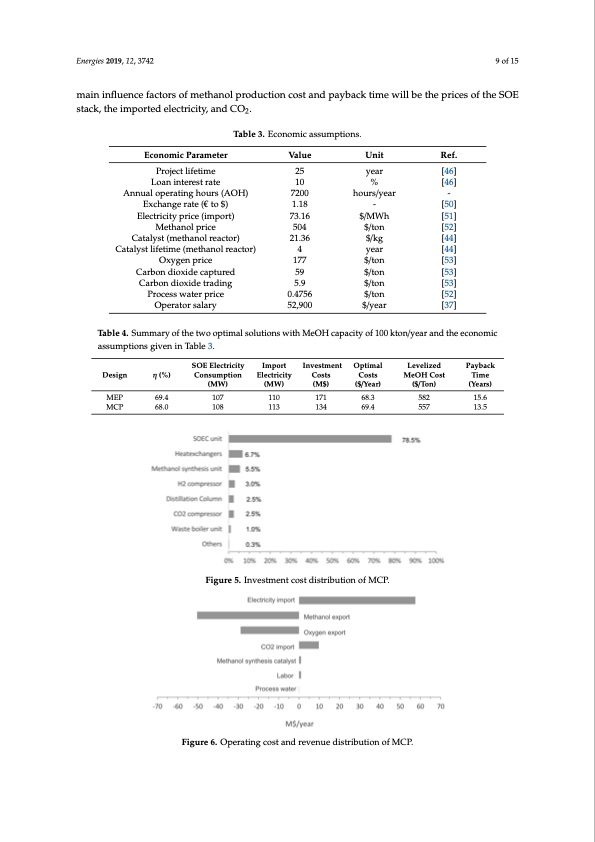

Energies 2018, 11, x FOR PEER REVIEW 9 of 15 Energies 2019, 12, 3742 9 of 15 Table 4. Summary of the two optimal solutions with MeOH capacity of 100 kton/year and the Energies 2018, 11, x FOR PEER REVIEW 9 of 15 economic assumptions given in Table 3. main influence factors of methanol production cost and payback time will be the prices of the SOE stack, the imported electricity, and CO . 2 Table 4. Summary of the two optimal solutions with MeOH capacity of 10L0ekvteolniz/eydear and the SOE Electricity Import Optimal Payback econom𝜼ic assumptions given in Table 3. Investment MeOH Design (%) Consumption Electricity Costs (M$) Costs Cost Time ($/Year) Levelized (Years) Design (%) Consumption Electricity Costs (M$) Costs Cost Time (MW) (MW) Optimal ($/Ton) Payback Unit MeORHef. Table 3. Economic assumptions. MEP 69.4 MCP 68.0 MEP 69.4 Economic Parameter 𝜼 SOE Electricity Import VaIlnuveestment 171 107 110 68.3 582 15.6 4.4. Cost Distribution Projec1t 0li8fetime 113 (MW) (MW) 25 134 y6e9ar.4 557[46] 13.5 ($/Year) ($/Ton) (Years) 10 7200 1.18 Catalyst (methanol reactor) 21.36 $/kg [44] both designs are not economically feasible with a payback time over 13 years. However, it is still Based on the economic assumptions given in Table 3, the two chosen designs are economically Loan interest rate 171 134 % [46] 68.3 582 15.6 MCP 68.0 108 113 107 110 hours/year - 69.4 557 13.5 Annual operating hours (AOH) Exchange rate (€ to $) BasedonEtlehcetreiciotynoprmiciec(aimsspuomrt)ptionsgiven7in3.1T6able3,thetw$/MoWchhosendesigns[5a1r]eeconomically - [50] 4.4. Cost DistributiMonethanol price 504 $/ton [52] evaluated with the key indicator given in Table 4. It shows that, for the given economic assumptions, Catalyst lifetime (methanol reactor) 4 year [44] interesting to understand the cost breakdown and identify the key contributors to the levelized evaluated with theOkxeygeindpirciacetor given in Table 4.17It7shows that, fo$r/ttohne given econo[m53i]c assumptions, methanol cost. The cost distribution is analyzed based on MCP. Figure 5 shows the investment $/ton [53] both designs are not economically feasible with a payback time over 13 years. However, it is still Carbon dioxide captured 59 distributionoCfatrhbeonpdriopxiodseetdradcainsgeatMCP.The5.9totalinvestme$n/ttonis133.8M$,[w53i]ththehighest interesting to understand the cost breakdown and identify the key contributors to the levelized $/ton [52] contribution from the SOE (79%). All other components contribute less than 10%, respectively. Figure methanol cost. The cost distribution is analyzed based on MCP. Figure 5 shows the investment Process water price 0.4756 $/year [37] 6 shows the distribution of operating cost (positive value) and revenue (negative value) of the distribution of the proposed case at MCP. The total investment is 133.8 M$, with the highest Operator salary 52,900 proposed case at MCP. The total operating cost (70 M$/year) is mostly contributed by the electricity contribution from the SOE (79%). All other components contribute less than 10%, respectively. Figure Table 4. Summary of the two optimal solutions with MeOH capacity of 100 kton/year and the economic consumption, about 50 M$/year, followed by the CO2 purchase, about 10 M$/year. The revenue comes 6 shows the distribution of operating cost (positive value) and revenue (negative value) of the assumptions given in Table 3. from the sale of methanol and byproduct oxygen, about 50 M$/year and 29 M$/year, respectively. proposed case at MCP. The total operating cost (70 M$/year) is mostly contributed by the electricity Therefore,itcanbeseentShOaEtEtlhecetrmicitayininIfmlupeonrtcefaIncvteosrtmseonftmeOtphtaimnaollprodLuevcetliiozendcostaPnadybpacakyback consumption, about 50 M$/year, followed by the CO2 purchase, about 10 M$/year. The revenue comes Design η (%) Consumption Electricity Costs Costs MeOH Cost Time time will be the prices of the SOE stack, the imported electricity, and CO2. from the sale of methanol and byproduct oxygen, about 50 M$/year and 29 M$/year, respectively. (MW) (MW) (M$) ($/Year) ($/Ton) (Years) Therefore, it can be seen that the main influence factors of methanol production cost and payback MEP 69.4 107 110 171 68.3 582 15.6 MCP 68.0 108 113 134 69.4 557 13.5 time will be the prices of the SOE stack, the imported electricity, and CO2. Figure 5. Investment cost distribution of MCP. Figure 5. Investment cost distribution of MCP. Figure 5. Investment cost distribution of MCP. Figure 6. Operating cost and revenue distribution of MCP. Figure 6. Operating cost and revenue distribution of MCP. 4.5.SensitivityAnalysis Figure6.OperatingcostandrevenuedistributionofMCP. 4.5. Sensitivity AnalysisPDF Image | Optimization of CO2-to-Methanol with Solid-Oxide Electrolyzer

PDF Search Title:

Optimization of CO2-to-Methanol with Solid-Oxide ElectrolyzerOriginal File Name Searched:

energies-12-03742.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |