PDF Publication Title:

Text from PDF Page: 012

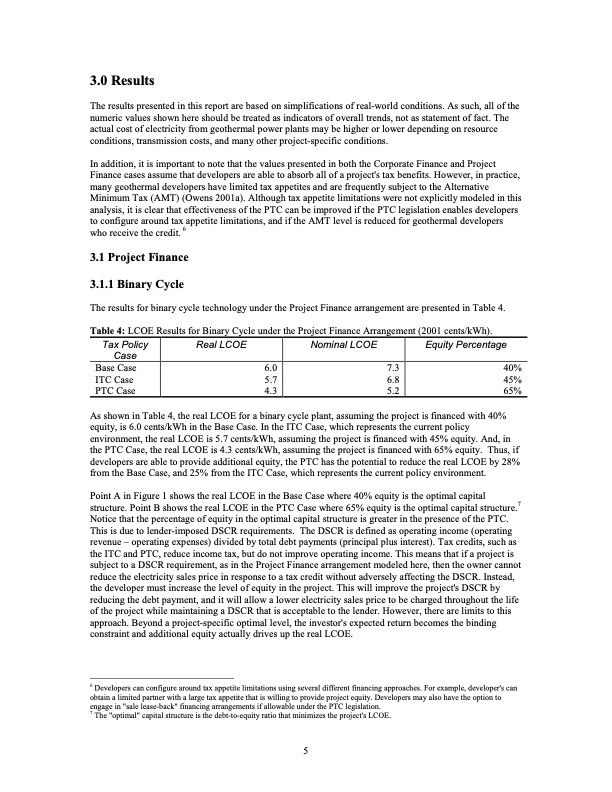

3.0 Results The results presented in this report are based on simplifications of real-world conditions. As such, all of the numeric values shown here should be treated as indicators of overall trends, not as statement of fact. The actual cost of electricity from geothermal power plants may be higher or lower depending on resource conditions, transmission costs, and many other project-specific conditions. In addition, it is important to note that the values presented in both the Corporate Finance and Project Finance cases assume that developers are able to absorb all of a project's tax benefits. However, in practice, many geothermal developers have limited tax appetites and are frequently subject to the Alternative Minimum Tax (AMT) (Owens 2001a). Although tax appetite limitations were not explicitly modeled in this analysis, it is clear that effectiveness of the PTC can be improved if the PTC legislation enables developers to configure around tax appetite limitations, and if the AMT level is reduced for geothermal developers who receive the credit. 6 3.1 Project Finance 3.1.1 Binary Cycle The results for binary cycle technology under the Project Finance arrangement are presented in Table 4. Table 4: LCOE Results for Binary Cycle under the Project Finance Arrangement (2001 cents/kWh). Tax Policy Case Base Case ITC Case PTC Case Real LCOE Nominal LCOE Equity Percentage 40% 45% 65% 6.0 5.7 4.3 7.3 6.8 5.2 As shown in Table 4, the real LCOE for a binary cycle plant, assuming the project is financed with 40% equity, is 6.0 cents/kWh in the Base Case. In the ITC Case, which represents the current policy environment, the real LCOE is 5.7 cents/kWh, assuming the project is financed with 45% equity. And, in the PTC Case, the real LCOE is 4.3 cents/kWh, assuming the project is financed with 65% equity. Thus, if developers are able to provide additional equity, the PTC has the potential to reduce the real LCOE by 28% from the Base Case, and 25% from the ITC Case, which represents the current policy environment. Point A in Figure 1 shows the real LCOE in the Base Case where 40% equity is the optimal capital structure. Point B shows the real LCOE in the PTC Case where 65% equity is the optimal capital structure.7 Notice that the percentage of equity in the optimal capital structure is greater in the presence of the PTC. This is due to lender-imposed DSCR requirements. The DSCR is defined as operating income (operating revenue – operating expenses) divided by total debt payments (principal plus interest). Tax credits, such as the ITC and PTC, reduce income tax, but do not improve operating income. This means that if a project is subject to a DSCR requirement, as in the Project Finance arrangement modeled here, then the owner cannot reduce the electricity sales price in response to a tax credit without adversely affecting the DSCR. Instead, the developer must increase the level of equity in the project. This will improve the project's DSCR by reducing the debt payment, and it will allow a lower electricity sales price to be charged throughout the life of the project while maintaining a DSCR that is acceptable to the lender. However, there are limits to this approach. Beyond a project-specific optimal level, the investor's expected return becomes the binding constraint and additional equity actually drives up the real LCOE. 6 Developers can configure around tax appetite limitations using several different financing approaches. For example, developer's can obtain a limited partner with a large tax appetite that is willing to provide project equity. Developers may also have the option to engage in "sale lease-back" financing arrangements if allowable under the PTC legislation. 7 The "optimal" capital structure is the debt-to-equity ratio that minimizes the project's LCOE. 5PDF Image | An Economic Valuation of a Geothermal Production Tax Credit

PDF Search Title:

An Economic Valuation of a Geothermal Production Tax CreditOriginal File Name Searched:

31969.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |