PDF Publication Title:

Text from PDF Page: 024

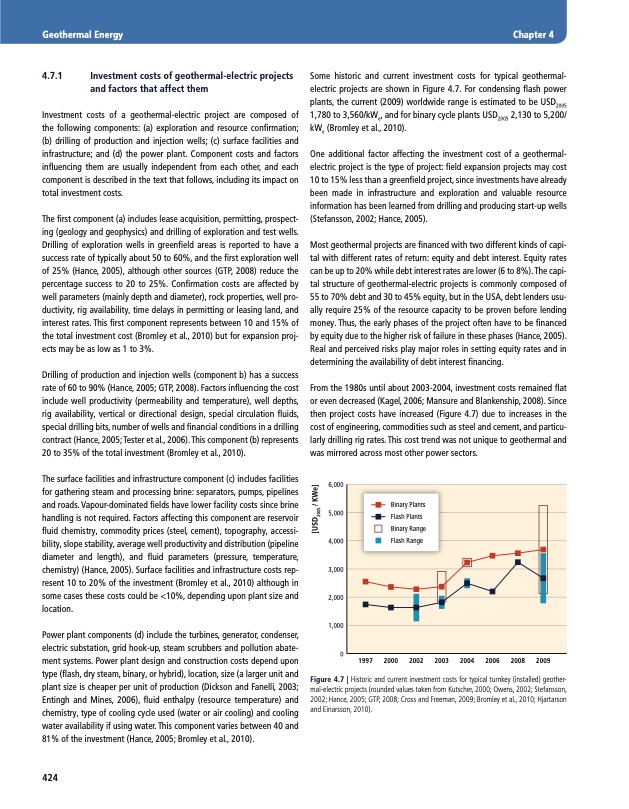

Geothermal Energy Chapter 4 4.7.1 Investment costs of geothermal-electric projects and factors that affect them Investment costs of a geothermal-electric project are composed of the following components: (a) exploration and resource confirmation; (b) drilling of production and injection wells; (c) surface facilities and infrastructure; and (d) the power plant. Component costs and factors influencing them are usually independent from each other, and each component is described in the text that follows, including its impact on total investment costs. The first component (a) includes lease acquisition, permitting, prospect- ing (geology and geophysics) and drilling of exploration and test wells. Drilling of exploration wells in greenfield areas is reported to have a success rate of typically about 50 to 60%, and the first exploration well of 25% (Hance, 2005), although other sources (GTP, 2008) reduce the percentage success to 20 to 25%. Confirmation costs are affected by well parameters (mainly depth and diameter), rock properties, well pro- ductivity, rig availability, time delays in permitting or leasing land, and interest rates. This first component represents between 10 and 15% of the total investment cost (Bromley et al., 2010) but for expansion proj- ects may be as low as 1 to 3%. Drilling of production and injection wells (component b) has a success rate of 60 to 90% (Hance, 2005; GTP, 2008). Factors influencing the cost include well productivity (permeability and temperature), well depths, rig availability, vertical or directional design, special circulation fluids, special drilling bits, number of wells and financial conditions in a drilling contract (Hance, 2005; Tester et al., 2006). This component (b) represents 20 to 35% of the total investment (Bromley et al., 2010). The surface facilities and infrastructure component (c) includes facilities for gathering steam and processing brine: separators, pumps, pipelines and roads. Vapour-dominated fields have lower facility costs since brine handling is not required. Factors affecting this component are reservoir fluid chemistry, commodity prices (steel, cement), topography, accessi- bility, slope stability, average well productivity and distribution (pipeline diameter and length), and fluid parameters (pressure, temperature, chemistry) (Hance, 2005). Surface facilities and infrastructure costs rep- resent 10 to 20% of the investment (Bromley et al., 2010) although in some cases these costs could be <10%, depending upon plant size and location. Power plant components (d) include the turbines, generator, condenser, electric substation, grid hook-up, steam scrubbers and pollution abate- ment systems. Power plant design and construction costs depend upon type (flash, dry steam, binary, or hybrid), location, size (a larger unit and plant size is cheaper per unit of production (Dickson and Fanelli, 2003; Entingh and Mines, 2006), fluid enthalpy (resource temperature) and chemistry, type of cooling cycle used (water or air cooling) and cooling water availability if using water. This component varies between 40 and 81% of the investment (Hance, 2005; Bromley et al., 2010). Some historic and current investment costs for typical geothermal- electric projects are shown in Figure 4.7. For condensing flash power plants, the current (2009) worldwide range is estimated to be USD2005 1,780 to 3,560/kWe, and for binary cycle plants USD2005 2,130 to 5,200/ kWe (Bromley et al., 2010). One additional factor affecting the investment cost of a geothermal- electric project is the type of project: field expansion projects may cost 10 to 15% less than a greenfield project, since investments have already been made in infrastructure and exploration and valuable resource information has been learned from drilling and producing start-up wells (Stefansson, 2002; Hance, 2005). Most geothermal projects are financed with two different kinds of capi- tal with different rates of return: equity and debt interest. Equity rates can be up to 20% while debt interest rates are lower (6 to 8%). The capi- tal structure of geothermal-electric projects is commonly composed of 55 to 70% debt and 30 to 45% equity, but in the USA, debt lenders usu- ally require 25% of the resource capacity to be proven before lending money. Thus, the early phases of the project often have to be financed by equity due to the higher risk of failure in these phases (Hance, 2005). Real and perceived risks play major roles in setting equity rates and in determining the availability of debt interest financing. From the 1980s until about 2003-2004, investment costs remained flat or even decreased (Kagel, 2006; Mansure and Blankenship, 2008). Since then project costs have increased (Figure 4.7) due to increases in the cost of engineering, commodities such as steel and cement, and particu- larly drilling rig rates. This cost trend was not unique to geothermal and was mirrored across most other power sectors. 6,000 5,000 4,000 3,000 2,000 1,000 0 Binary Plants Flash Plants Binary Range Flash Range 424 1997 2000 2002 2003 2004 2006 2008 2009 Figure 4.7 | Historic and current investment costs for typical turnkey (installed) geother- mal-electric projects (rounded values taken from Kutscher, 2000; Owens, 2002; Stefansson, 2002; Hance, 2005; GTP, 2008; Cross and Freeman, 2009; Bromley et al., 2010; Hjartarson and Einarsson, 2010). [USD2005 / KWe]PDF Image | Geothermal Energy 4

PDF Search Title:

Geothermal Energy 4Original File Name Searched:

Chapter_4_Geothermal_Energy_.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |