PDF Publication Title:

Text from PDF Page: 067

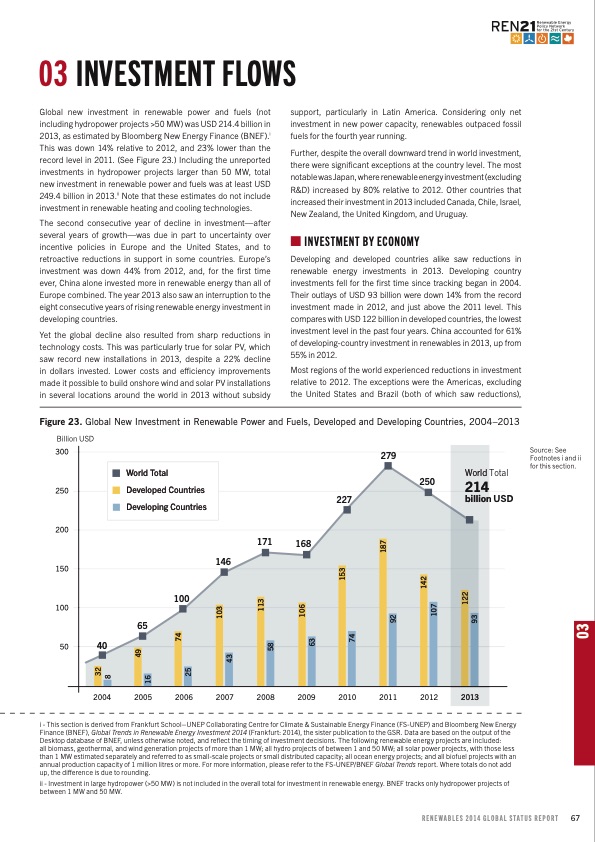

03 INVESTMENT FLOWS Global new investment in renewable power and fuels (not including hydropower projects >50 MW) was USD 214.4 billion in 2013, as estimated by Bloomberg New Energy Finance (BNEF).i This was down 14% relative to 2012, and 23% lower than the record level in 2011. (See Figure 23.) Including the unreported investments in hydropower projects larger than 50 MW, total new investment in renewable power and fuels was at least USD 249.4 billion in 2013.ii Note that these estimates do not include investment in renewable heating and cooling technologies. The second consecutive year of decline in investment—after several years of growth—was due in part to uncertainty over incentive policies in Europe and the United States, and to retroactive reductions in support in some countries. Europe’s investment was down 44% from 2012, and, for the first time ever, China alone invested more in renewable energy than all of Europe combined. The year 2013 also saw an interruption to the eight consecutive years of rising renewable energy investment in developing countries. Yet the global decline also resulted from sharp reductions in technology costs. This was particularly true for solar PV, which saw record new installations in 2013, despite a 22% decline in dollars invested. Lower costs and efficiency improvements made it possible to build onshore wind and solar PV installations in several locations around the world in 2013 without subsidy support, particularly in Latin America. Considering only net investment in new power capacity, renewables outpaced fossil fuels for the fourth year running. Further, despite the overall downward trend in world investment, there were significant exceptions at the country level. The most notable was Japan, where renewable energy investment (excluding R&D) increased by 80% relative to 2012. Other countries that increased their investment in 2013 included Canada, Chile, Israel, New Zealand, the United Kingdom, and Uruguay. ■■INVESTMENT BY ECONOMY Developing and developed countries alike saw reductions in renewable energy investments in 2013. Developing country investments fell for the first time since tracking began in 2004. Their outlays of USD 93 billion were down 14% from the record investment made in 2012, and just above the 2011 level. This compares with USD 122 billion in developed countries, the lowest investment level in the past four years. China accounted for 61% of developing-country investment in renewables in 2013, up from 55% in 2012. Most regions of the world experienced reductions in investment relative to 2012. The exceptions were the Americas, excluding the United States and Brazil (both of which saw reductions), Figure 23. Global New Investment in Renewable Power and Fuels, Developed and Developing Countries, 2004–2013 Figure 23. Global New Investment in Renewable Power and Fuels, Developed and Developing Countries, 2004–2013 Billion USD 300 250 200 150 100 50 279 Source: See Footnotes i and ii for this section. World Total 250 billion USD 214 World Total Developed Countries Developing Countries 100 171 146 168 227 65 40 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Does not include investment in hydropower > 50 MW i - This section is derived from Frankfurt School–UNEP Collaborating Centre for Climate & Sustainable Energy Finance (FS-UNEP) and Bloomberg New Energy Finance (BNEF), Global Trends in Renewable Energy Investment 2014 (Frankfurt: 2014), the sister publication to the GSR. Data are based on the output of the Desktop database of BNEF, unless otherwise noted, and reflect the timing of investment decisions. The following renewable energy projects are included: all biomass, geothermal, and wind generation projects of more than 1 MW; all hydro projects of between 1 and 50 MW; all solar power projects, with those less than 1 MW estimated separately and referred to as small-scale projects or small distributed capacity; all ocean energy projects; and all biofuel projects with an annual production capacity of 1 million litres or more. For more information, please refer to the FS-UNEP/BNEF Global Trends report. Where totals do not add up, the difference is due to rounding. ii - Investment in large hydropower (>50 MW) is not included in the overall total for investment in renewable energy. BNEF tracks only hydropower projects of between 1 MW and 50 MW. RENEWABLES 2014 GLOBAL STATUS REPORT 67 3 32 8 49 16 74 25 103 43 113 58 106 63 74 03 92 142 107 122 93 153 187PDF Image | About ElectraTherm

PDF Search Title:

About ElectraThermOriginal File Name Searched:

gsr2014_full_report_low_res.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |