PDF Publication Title:

Text from PDF Page: 070

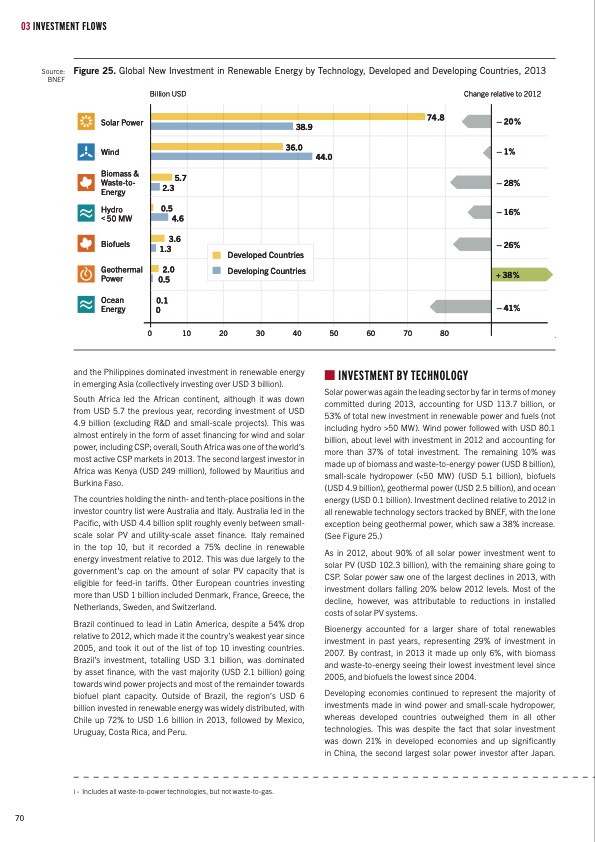

03 INVESTMENT FLOWS Source: BNEF FFigiguurere25. GlloballNNeewwInIvnevsetmstemnet nint RinenReewnaebwleaEbnlerEgny ebrygTyebcyhnToelocghyn,oDloegvey,loDpedvealnodpeDdevaenlodpDinegvCeoloupnitnrigesC, o2u0n1t3ries, 2013 Billion USD Change relative to 2012 – 20% – 1% – 28% – 16% – 26% + 38% – 41% Solar Power Wind Biomass & Waste-to- Energy Hydro < 50 MW Biofuels Geothermal Power Ocean Energy 38.9 74 .8 5.7 2.3 0.5 4.6 3.6 1.3 36.0 44.0 2.0 0.5 0.1 0 Developed Countries Developing Countries 0 10 20 30 40 50 60 70 80 70 and the Philippines dominated investment in renewable energy in emerging Asia (collectively investing over USD 3 billion). South Africa led the African continent, although it was down from USD 5.7 the previous year, recording investment of USD 4.9 billion (excluding R&D and small-scale projects). This was almost entirely in the form of asset financing for wind and solar power, including CSP; overall, South Africa was one of the world’s most active CSP markets in 2013. The second largest investor in Africa was Kenya (USD 249 million), followed by Mauritius and Burkina Faso. The countries holding the ninth- and tenth-place positions in the investor country list were Australia and Italy. Australia led in the Pacific, with USD 4.4 billion split roughly evenly between small- scale solar PV and utility-scale asset finance. Italy remained in the top 10, but it recorded a 75% decline in renewable energy investment relative to 2012. This was due largely to the government’s cap on the amount of solar PV capacity that is eligible for feed-in tariffs. Other European countries investing more than USD 1 billion included Denmark, France, Greece, the Netherlands, Sweden, and Switzerland. Brazil continued to lead in Latin America, despite a 54% drop relative to 2012, which made it the country’s weakest year since 2005, and took it out of the list of top 10 investing countries. Brazil’s investment, totalling USD 3.1 billion, was dominated by asset finance, with the vast majority (USD 2.1 billion) going towards wind power projects and most of the remainder towards biofuel plant capacity. Outside of Brazil, the region’s USD 6 billion invested in renewable energy was widely distributed, with Chile up 72% to USD 1.6 billion in 2013, followed by Mexico, Uruguay, Costa Rica, and Peru. ■■INVESTMENT BY TECHNOLOGY Solar power was again the leading sector by far in terms of money committed during 2013, accounting for USD 113.7 billion, or 53% of total new investment in renewable power and fuels (not including hydro >50 MW). Wind power followed with USD 80.1 billion, about level with investment in 2012 and accounting for more than 37% of total investment. The remaining 10% was made up of biomass and waste-to-energyi power (USD 8 billion), small-scale hydropower (<50 MW) (USD 5.1 billion), biofuels (USD 4.9 billion), geothermal power (USD 2.5 billion), and ocean energy (USD 0.1 billion). Investment declined relative to 2012 in all renewable technology sectors tracked by BNEF, with the lone exception being geothermal power, which saw a 38% increase. (See Figure 25.) As in 2012, about 90% of all solar power investment went to solar PV (USD 102.3 billion), with the remaining share going to CSP. Solar power saw one of the largest declines in 2013, with investment dollars falling 20% below 2012 levels. Most of the decline, however, was attributable to reductions in installed costs of solar PV systems. Bioenergy accounted for a larger share of total renewables investment in past years, representing 29% of investment in 2007. By contrast, in 2013 it made up only 6%, with biomass and waste-to-energy seeing their lowest investment level since 2005, and biofuels the lowest since 2004. Developing economies continued to represent the majority of investments made in wind power and small-scale hydropower, whereas developed countries outweighed them in all other technologies. This was despite the fact that solar investment was down 21% in developed economies and up significantly in China, the second largest solar power investor after Japan. i - Includes all waste-to-power technologies, but not waste-to-gas.PDF Image | About ElectraTherm

PDF Search Title:

About ElectraThermOriginal File Name Searched:

gsr2014_full_report_low_res.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |