PDF Publication Title:

Text from PDF Page: 035

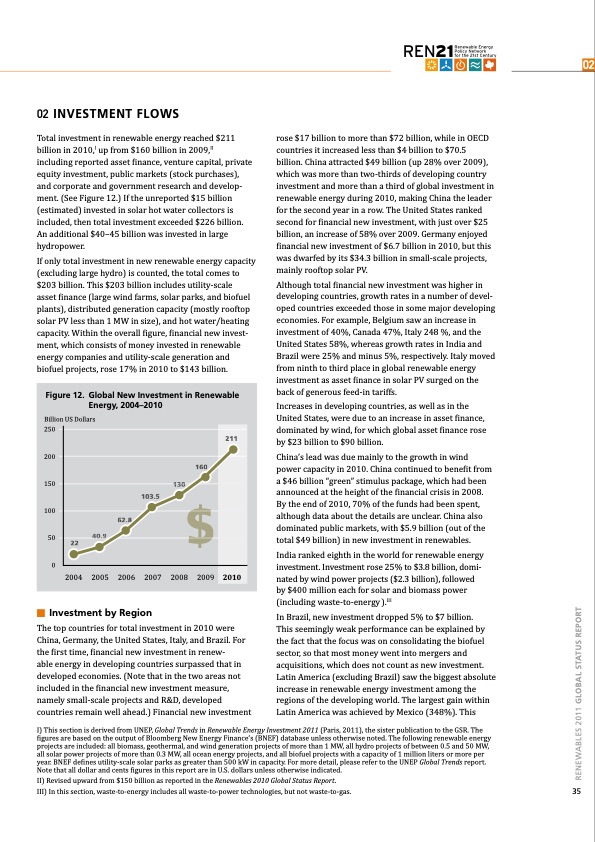

02 InVeSTMenT flOwS rose $17 billion to more than $72 billion, while in OECD countries it increased less than $4 billion to $70.5 billion. China attracted $49 billion (up 28% over 2009), which was more than two-thirds of developing country investment and more than a third of global investment in renewable energy during 2010, making China the leader for the second year in a row. The United States ranked second for financial new investment, with just over $25 billion, an increase of 58% over 2009. Germany enjoyed financial new investment of $6.7 billion in 2010, but this was dwarfed by its $34.3 billion in small-scale projects, mainly rooftop solar PV. Total investment in renewable energy reached $211 billion in 2010,I up from $160 billion in 2009,II including reported asset finance, venture capital, private equity investment, public markets (stock purchases), and corporate and government research and develop- ment. (See Figure 12.) If the unreported $15 billion (estimated) invested in solar hot water collectors is included, then total investment exceeded $226 billion. An additional $40–45 billion was invested in large hydropower. If only total investment in new renewable energy capacity (excluding large hydro) is counted, the total comes to $203 billion. This $203 billion includes utility-scale asset finance (large wind farms, solar parks, and biofuel plants), distributed generation capacity (mostly rooftop solar PV less than 1 MW in size), and hot water/heating capacity. Within the overall figure, financial new invest- ment, which consists of money invested in renewable energy companies and utility-scale generation and biofuel projects, rose 17% in 2010 to $143 billion. Although total financial new investment was higher in developing countries, growth rates in a number of devel- oped countries exceeded those in some major developing economies. For example, Belgium saw an increase in investment of 40%, Canada 47%, Italy 248 %, and the United States 58%, whereas growth rates in India and Brazil were 25% and minus 5%, respectively. Italy moved from ninth to third place in global renewable energy investment as asset finance in solar PV surged on the back of generous feed-in tariffs. Increases in developing countries, as well as in the United States, were due to an increase in asset finance, dominated by wind, for which global asset finance rose by $23 billion to $90 billion. 02 figure 12. Global new Investment in Renewable energy, 2004–2010 Billion US Dollars 250 211 160 0 2004 2005 2006 2007 2008 2009 2010 200 150 130 100 103.5 50 62.8 40.9 22 The top countries for total investment in 2010 were China, Germany, the United States, Italy, and Brazil. For the first time, financial new investment in renew- able energy in developing countries surpassed that in developed economies. (Note that in the two areas not included in the financial new investment measure, namely small-scale projects and R&D, developed countries remain well ahead.) Financial new investment In Brazil, new investment dropped 5% to $7 billion. This seemingly weak performance can be explained by the fact that the focus was on consolidating the biofuel sector, so that most money went into mergers and acquisitions, which does not count as new investment. Latin America (excluding Brazil) saw the biggest absolute increase in renewable energy investment among the regions of the developing world. The largest gain within Latin America was achieved by Mexico (348%). This n Investment by Region I) This section is derived from UNEP, Global Trends in Renewable Energy Investment 2011 (Paris, 2011), the sister publication to the GSR. The figures are based on the output of Bloomberg New Energy Finance’s (BNEF) database unless otherwise noted. The following renewable energy projects are included: all biomass, geothermal, and wind generation projects of more than 1 MW, all hydro projects of between 0.5 and 50 MW, all solar power projects of more than 0.3 MW, all ocean energy projects, and all biofuel projects with a capacity of 1 million liters or more per year. BNEF defines utility-scale solar parks as greater than 500 kW in capacity. For more detail, please refer to the UNEP Global Trends report. Note that all dollar and cents figures in this report are in U.S. dollars unless otherwise indicated. China’s lead was due mainly to the growth in wind power capacity in 2010. China continued to benefit from a $46 billion “green” stimulus package, which had been announced at the height of the financial crisis in 2008. By the end of 2010, 70% of the funds had been spent, although data about the details are unclear. China also dominated public markets, with $5.9 billion (out of the total $49 billion) in new investment in renewables. India ranked eighth in the world for renewable energy investment. Investment rose 25% to $3.8 billion, domi- nated by wind power projects ($2.3 billion), followed by $400 million each for solar and biomass power (including waste-to-energy ).III II) Revised upward from $150 billion as reported in the Renewables 2010 Global Status Report. III) In this section, waste-to-energy includes all waste-to-power technologies, but not waste-to-gas. 35 RENEWABLES 2011 GlObal STaTuS RePORTPDF Image | GLOBAL STATUS REPORT Renewables 2011

PDF Search Title:

GLOBAL STATUS REPORT Renewables 2011Original File Name Searched:

gsr2011.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |