PDF Publication Title:

Text from PDF Page: 036

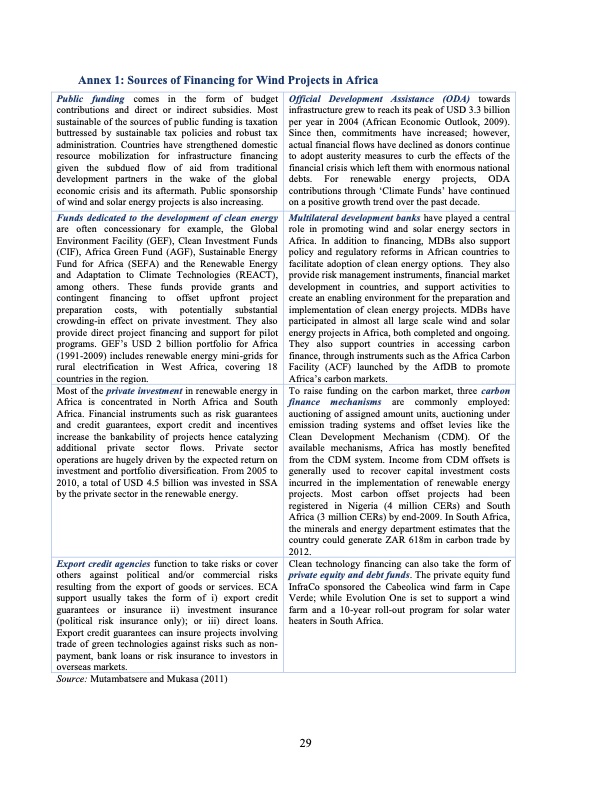

Annex 1: Sources of Financing for Wind Projects in Africa Public funding comes in the form of budget contributions and direct or indirect subsidies. Most sustainable of the sources of public funding is taxation buttressed by sustainable tax policies and robust tax administration. Countries have strengthened domestic resource mobilization for infrastructure financing given the subdued flow of aid from traditional development partners in the wake of the global economic crisis and its aftermath. Public sponsorship of wind and solar energy projects is also increasing. Official Development Assistance (ODA) towards infrastructure grew to reach its peak of USD 3.3 billion per year in 2004 (African Economic Outlook, 2009). Since then, commitments have increased; however, actual financial flows have declined as donors continue to adopt austerity measures to curb the effects of the financial crisis which left them with enormous national debts. For renewable energy projects, ODA contributions through ‘Climate Funds’ have continued on a positive growth trend over the past decade. Funds dedicated to the development of clean energy are often concessionary for example, the Global Environment Facility (GEF), Clean Investment Funds (CIF), Africa Green Fund (AGF), Sustainable Energy Fund for Africa (SEFA) and the Renewable Energy and Adaptation to Climate Technologies (REACT), among others. These funds provide grants and contingent financing to offset upfront project preparation costs, with potentially substantial crowding-in effect on private investment. They also provide direct project financing and support for pilot programs. GEF’s USD 2 billion portfolio for Africa (1991-2009) includes renewable energy mini-grids for rural electrification in West Africa, covering 18 countries in the region. Multilateral development banks have played a central role in promoting wind and solar energy sectors in Africa. In addition to financing, MDBs also support policy and regulatory reforms in African countries to facilitate adoption of clean energy options. They also provide risk management instruments, financial market development in countries, and support activities to create an enabling environment for the preparation and implementation of clean energy projects. MDBs have participated in almost all large scale wind and solar energy projects in Africa, both completed and ongoing. They also support countries in accessing carbon finance, through instruments such as the Africa Carbon Facility (ACF) launched by the AfDB to promote Africa’s carbon markets. Most of the private investment in renewable energy in Africa is concentrated in North Africa and South Africa. Financial instruments such as risk guarantees and credit guarantees, export credit and incentives increase the bankability of projects hence catalyzing additional private sector flows. Private sector operations are hugely driven by the expected return on investment and portfolio diversification. From 2005 to 2010, a total of USD 4.5 billion was invested in SSA by the private sector in the renewable energy. To raise funding on the carbon market, three carbon finance mechanisms are commonly employed: auctioning of assigned amount units, auctioning under emission trading systems and offset levies like the Clean Development Mechanism (CDM). Of the available mechanisms, Africa has mostly benefited from the CDM system. Income from CDM offsets is generally used to recover capital investment costs incurred in the implementation of renewable energy projects. Most carbon offset projects had been registered in Nigeria (4 million CERs) and South Africa (3 million CERs) by end-2009. In South Africa, the minerals and energy department estimates that the country could generate ZAR 618m in carbon trade by 2012. Export credit agencies function to take risks or cover others against political and/or commercial risks resulting from the export of goods or services. ECA support usually takes the form of i) export credit guarantees or insurance ii) investment insurance (political risk insurance only); or iii) direct loans. Export credit guarantees can insure projects involving trade of green technologies against risks such as non- payment, bank loans or risk insurance to investors in overseas markets. Clean technology financing can also take the form of private equity and debt funds. The private equity fund InfraCo sponsored the Cabeolica wind farm in Cape Verde; while Evolution One is set to support a wind farm and a 10-year roll-out program for solar water heaters in South Africa. Source: Mutambatsere and Mukasa (2011) 29PDF Image | Development of Wind Energy in Africa

PDF Search Title:

Development of Wind Energy in AfricaOriginal File Name Searched:

Working_Paper_170___Development_of_Wind_Energy_in_Africa.pdfDIY PDF Search: Google It | Yahoo | Bing

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

IT XR Project Redstone NFT Available for Sale: NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Be part of the future with this NFT. Can be bought and sold but only one design NFT exists. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Turbine IT XR Project Redstone Design: NFT for sale... NFT for high tech turbine design with one part 3D printed counter-rotating energy turbine. Includes all rights to this turbine design, including license for Fluid Handling Block I and II for the turbine assembly and housing. The NFT includes the blueprints (cad/cam), revenue streams, and all future development of the IT XR Project Redstone... More Info

Infinity Turbine ROT Radial Outflow Turbine 24 Design and Worldwide Rights: NFT for sale... NFT for the ROT 24 energy turbine. Be part of the future with this NFT. This design can be bought and sold but only one design NFT exists. You may manufacture the unit, or get the revenues from its sale from Infinity Turbine. Royalties go to the developer (Infinity) to keep enhancing design and applications... More Info

Infinity Supercritical CO2 10 Liter Extractor Design and Worldwide Rights: The Infinity Supercritical 10L CO2 extractor is for botanical oil extraction, which is rich in terpenes and can produce shelf ready full spectrum oil. With over 5 years of development, this industry leader mature extractor machine has been sold since 2015 and is part of many profitable businesses. The process can also be used for electrowinning, e-waste recycling, and lithium battery recycling, gold mining electronic wastes, precious metals. CO2 can also be used in a reverse fuel cell with nafion to make a gas-to-liquids fuel, such as methanol, ethanol and butanol or ethylene. Supercritical CO2 has also been used for treating nafion to make it more effective catalyst. This NFT is for the purchase of worldwide rights which includes the design. More Info

NFT (Non Fungible Token): Buy our tech, design, development or system NFT and become part of our tech NFT network... More Info

Infinity Turbine Products: Special for this month, any plans are $10,000 for complete Cad/Cam blueprints. License is for one build. Try before you buy a production license. May pay by Bitcoin or other Crypto. Products Page... More Info

| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |