PDF Publication Title:

Text from PDF Page: 010

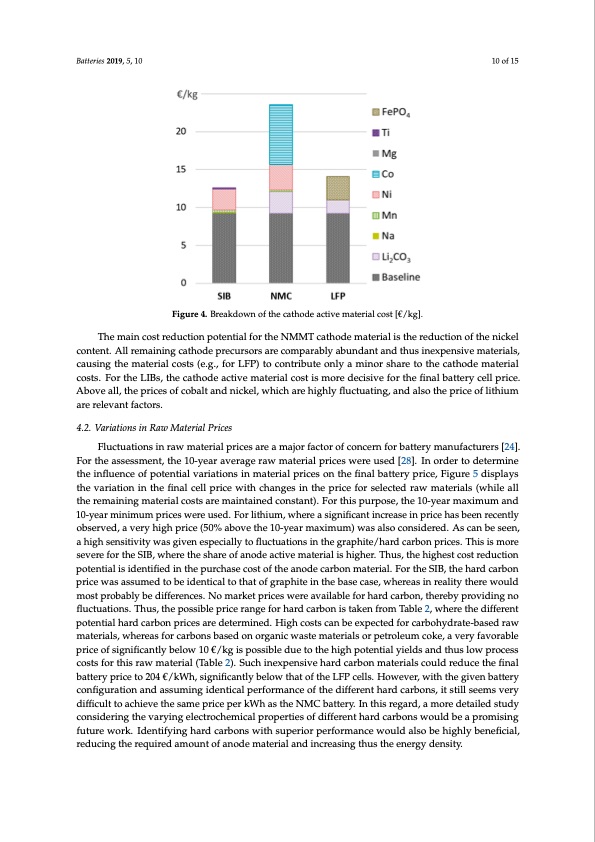

Batteries 2019, 5, 10 10 of 15 Batteries 2019, 5, x FOR PEER REVIEW 10 of 15 Figure 4. Breakdown of the cathode active material cost [€/kg]. Figure 4. Breakdown of the cathode active material cost [€/kg]. The main cost reduction potential for the NMMT cathode material is the reduction of the nickel The main cost reduction potential for the NMMT cathode material is the reduction of the nickel content. All remaining cathode precursors are comparably abundant and thus inexpensive materials, content. All remaining cathode precursors are comparably abundant and thus inexpensive causing the material costs (e.g., for LFP) to contribute only a minor share to the cathode material materials, causing the material costs (e.g., for LFP) to contribute only a minor share to the cathode costs. For the LIBs, the cathode active material cost is more decisive for the final battery cell price. material costs. For the LIBs, the cathode active material cost is more decisive for the final battery Above all, the prices of cobalt and nickel, which are highly fluctuating, and also the price of lithium cell price. Above all, the prices of cobalt and nickel, which are highly fluctuating, and also the price are relevant factors. of lithium are relevant factors. 4.2. Variations in Raw Material Prices 4.2. Variations in Raw Material Prices Fluctuations in raw material prices are a major factor of concern for battery manufacturers [24]. Fluctuations in raw material prices are a major factor of concern for battery manufacturers [24]. For the assessment, the 10-year average raw material prices were used [28]. In order to determine For the assessment, the 10-year average raw material prices were used [28]. In order to determine the influence of potential variations in material prices on the final battery price, Figure 5 displays the influence of potential variations in material prices on the final battery price, Figure 5 displays the variation in the final cell price with changes in the price for selected raw materials (while all the variation in the final cell price with changes in the price for selected raw materials (while all the the remaining material costs are maintained constant). For this purpose, the 10-year maximum and remaining material costs are maintained constant). For this purpose, the 10-year maximum and 10- 10-year minimum prices were used. For lithium, where a significant increase in price has been recently year minimum prices were used. For lithium, where a significant increase in price has been recently observed, a very high price (50% above the 10-year maximum) was also considered. As can be seen, observed, a very high price (50% above the 10-year maximum) was also considered. As can be seen, a high sensitivity was given especially to fluctuations in the graphite/hard carbon prices. This is more a high sensitivity was given especially to fluctuations in the graphite/hard carbon prices. This is severe for the SIB, where the share of anode active material is higher. Thus, the highest cost reduction more severe for the SIB, where the share of anode active material is higher. Thus, the highest cost potential is identified in the purchase cost of the anode carbon material. For the SIB, the hard carbon reduction potential is identified in the purchase cost of the anode carbon material. For the SIB, the price was assumed to be identical to that of graphite in the base case, whereas in reality there would hard carbon price was assumed to be identical to that of graphite in the base case, whereas in reality most probably be differences. No market prices were available for hard carbon, thereby providing no there would most probably be differences. No market prices were available for hard carbon, fluctuations. Thus, the possible price range for hard carbon is taken from Table 2, where the different thereby providing no fluctuations. Thus, the possible price range for hard carbon is taken from potential hard carbon prices are determined. High costs can be expected for carbohydrate-based raw Table 2, where the different potential hard carbon prices are determined. High costs can be materials, whereas for carbons based on organic waste materials or petroleum coke, a very favorable expected for carbohydrate-based raw materials, whereas for carbons based on organic waste price of significantly below 10 €/kg is possible due to the high potential yields and thus low process materials or petroleum coke, a very favorable price of significantly below 10 €/kg is possible due to costs for this raw material (Table 2). Such inexpensive hard carbon materials could reduce the final the high potential yields and thus low process costs for this raw material (Table 2). Such battery price to 204 €/kWh, significantly below that of the LFP cells. However, with the given battery inexpensive hard carbon materials could reduce the final battery price to 204 €/kWh, significantly configuration and assuming identical performance of the different hard carbons, it still seems very below that of the LFP cells. However, with the given battery configuration and assuming identical difficult to achieve the same price per kWh as the NMC battery. In this regard, a more detailed study performance of the different hard carbons, it still seems very difficult to achieve the same price per considering the varying electrochemical properties of different hard carbons would be a promising kWh as the NMC battery. In this regard, a more detailed study considering the varying future work. Identifying hard carbons with superior performance would also be highly beneficial, electrochemical properties of different hard carbons would be a promising future work. Identifying reducing the required amount of anode material and increasing thus the energy density. hard carbons with superior performance would also be highly beneficial, reducing the required amount of anode material and increasing thus the energy density.PDF Image | Exploring the Economic Potential of Sodium-Ion Batteries

PDF Search Title:

Exploring the Economic Potential of Sodium-Ion BatteriesOriginal File Name Searched:

Exploring_the_Economic_Potential_of_Sodium-Ion_Bat.pdfDIY PDF Search: Google It | Yahoo | Bing

Salgenx Redox Flow Battery Technology: Salt water flow battery technology with low cost and great energy density that can be used for power storage and thermal storage. Let us de-risk your production using our license. Our aqueous flow battery is less cost than Tesla Megapack and available faster. Redox flow battery. No membrane needed like with Vanadium, or Bromine. Salgenx flow battery

| CONTACT TEL: 608-238-6001 Email: greg@salgenx.com | RSS | AMP |